Smartasset paycheck calculator georgia

If you record in Georgia since a single individual you will obtain taxed 1 of your taxable income under 750. Georgia Salary Paycheck Calculator.

A Pause In The Rally Then More Gains

Utilize SmartAssets paycheck calculator to determine your collect pay per paycheck for both income and hourly jobs after considering federal state and taxes that are local.

. Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. Georgia Hourly Paycheck Calculator.

You will drop any money you put in above 500 unless you use. Ad Create professional looking paystubs. All Services Backed by Tax Guarantee.

2 with regard to Social Security plus 1. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. In a few easy steps you can create your own paystubs and have them sent to your email.

We use the most recent and accurate information. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

The end result is the FICA taxes you pay out are still just 6. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Utilize SmartAssets paycheck calculator to determine your collect pay per paycheck for both income and hourly jobs after considering federal state and taxes that are. Ad Process Payroll Faster Easier With ADP Payroll. 45 with regard to Medicare.

Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Just enter the wages tax withholdings and other information required. The effective rate state-wide comes to 0957 which costs the average Georgian 155130 a year based on the median.

Compound Interest Calculator Daily Monthly Quarterly Annual

What You Actually Take Home From A 200 000 Salary In Every State

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Compound Interest Calculator Daily Monthly Quarterly Annual

Reducing Capital Gains Taxes On A Rental Property Smartasset

The Pros And Cons Of Credit Card Churning Smartasset

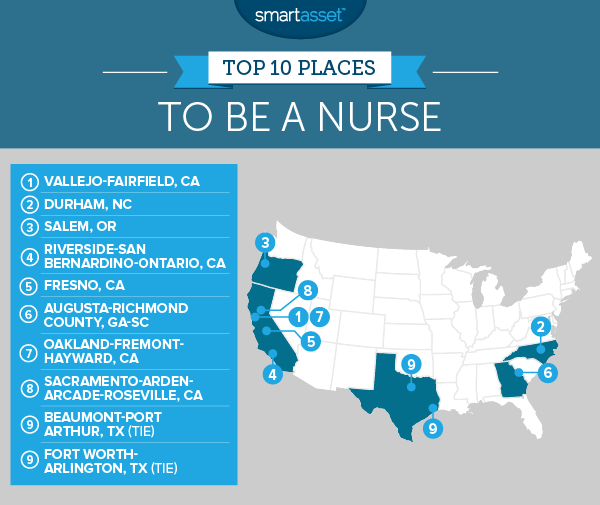

The Best Places To Be A Nurse 2016 Edition Smartasset

How Does Government Pension Offset Work Smartasset

Is Your State Giving Out Inflation Stimulus Checks

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Retirement Strategies Savings And Investment

What Is An Annuity Exclusion Ratio How Does It Work

How Taxes On Lottery Winnings Work Smartasset

Reducing Capital Gains Taxes On A Rental Property Smartasset

Standard Deduction How Much Is It And How Do You Take It Smartasset

Jabnmbvj4h2m

State Flag Of Georgia Usa American Images Georgia Flag Flag State Flags

States That Don T Tax Retirement Income Personal Capital